In fairy tales love conquers all; but in reality, money issues may be more dangerous to a marriage than even the worst villain.

In fact, money is one of the top reasons for divorce, causing almost 41 percent, according to The Austin Institute for The Study of Family and Culture. What’s more, the National Marriage Project reports that couples who disagree about finances once a week were over 30 percent more likely to divorce over time than couples who disagree about finances a few times per month.

In fact, money is one of the top reasons for divorce, causing almost 41 percent, according to The Austin Institute for The Study of Family and Culture. What’s more, the National Marriage Project reports that couples who disagree about finances once a week were over 30 percent more likely to divorce over time than couples who disagree about finances a few times per month.

How do you break the spell when it comes to marriage and money? Read on.

Common Money Issues in Marriage

Perhaps surprisingly, a lack of money is not the only issue that comes between spouses, especially those of us in the military.

Other money issues in marriage include:

- Being able to weather financial peaks and valleys

- Different money habits (spender versus saver)

- Power struggles resulting from one partner making more money

- Different financial values and goals (live in the now versus plan for the future)

- Secret spending such as purchases the other partner doesn’t know about or gambling

- How much money/debt one partner brings into the marriage

Making It Work

Often, it’s not even a big financial crisis like a job loss that causes problems. It’s little things that build up over time to cause resentment and stress which eventually lead to a breaking point. That’s why it’s so important to take these proactive steps:

Often, it’s not even a big financial crisis like a job loss that causes problems. It’s little things that build up over time to cause resentment and stress which eventually lead to a breaking point. That’s why it’s so important to take these proactive steps:

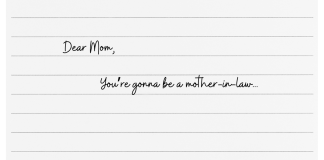

- Be upfront: Make a point to talk to each other about your financial history early on. It shouldn’t come as a shock to your spouse years into the marriage that you have significant student loan debt for example.

- Communicate expectations: You can’t be on the same page about money if you don’t set expectations. Talk about your financial goals (short- and long-term) and then create a budget for how you’ll spend and save. Don’t forget to re-evaluate on at least a yearly basis.

- Define your roles: Rarely does each partner make exactly the same amount of money, which can lead to a power struggle. To avoid this, define your roles in a way that plays up each of your strengths and helps you to both have ownership. For example, one of you may pay the bills and manage the day-to-day finances while the other manages your investment portfolio.

- Address issues as they arise: It’s when money concerns fester and build that the real problems begin so make a point to talk to your partner if something is bothering you. But remember to approach the conversation in a non-confrontational manner as people tend to take their money habits very personally.

- Create a money saving and spending plan and review it monthly: Especially if your spouse is deployed. He or she may be worried about how you are spending money and the last thing you want is more stress, so create a sharable sheet and be upfront about your spending- MINT and Dave Ramsey have great plans!

When Marriage and Money Don’t Mix

When Marriage and Money Don’t Mix

If you still find yourself struggling with your spouse over money, mediation can help. It’s not just for divorce; a trained mediator who acts as a neutral third party can help you negotiate a mutual agreement on money issues as well by helping you to brainstorm solutions and guide you in communicating more effectively with each other.

Learn more about our online mediation services by contacting our experienced team today!

Debra Whitson has been practicing law for more than 20 years, delivering focused solutions guided by compassion and trust. For the first half of her legal career, Debra was a special victims prosecutor, pursuing justice for crime victims, particularly women and children. She was the first female Assistant District Attorney serving Essex County and is a recognized expert in the fields of Domestic Violence and Sexual Assault. This passion for helping families led Debra to family law, and to pursue collaborative divorce and mediation.

Debra Whitson has been practicing law for more than 20 years, delivering focused solutions guided by compassion and trust. For the first half of her legal career, Debra was a special victims prosecutor, pursuing justice for crime victims, particularly women and children. She was the first female Assistant District Attorney serving Essex County and is a recognized expert in the fields of Domestic Violence and Sexual Assault. This passion for helping families led Debra to family law, and to pursue collaborative divorce and mediation.

Today, Debra works hands-on with her clients to learn their short-term objectives and long-range goals. Through this, she develops tailored options and explores how/if those options align with the client’s values, budget, risk tolerance, etc. She then co-produces strategies with her clients that will offer the best chance for advancing the client’s objectives/goals. Debra believes that there may be many paths to get you to where you want to be and advises clients to choose a path that aligns with their values. Through Mediated Online Solutions, she puts her passion for peaceful dispute resolution to work for couples who seek a dignified and self-directed way to separate, divorce, or co-parent. That same spirit guides Whitson&Tansey’s commitment to fighting for social justice and human rights by focusing on the firm’s practice on domestic violence, matrimonial, and family law.

Debra’s driving goal is to let her clients feel heard, cared for, and respected, and get as many people as possible to resolve conflicts in peaceful, respectful ways—in all spheres.

Awards: Debra is a two-time recipient of the Excellence in Domestic Violence Awareness andAdvocacy Award from the Essex County New York Multidisciplinary Task Force Against Domestic Violence, and she has been recognized for excellence in appellate advocacy from the Association of Government Attorneys in Capital Litigation.

In her spare time, Debra works with Zonta International to improve the lives of women and girls in her local community and around the globe. She loves to travel, good food and wine, tennis, and spending time with her husband and children enjoying all of the outdoor activities available in the Adirondack Mountains of New York State where they make their home.